INFORMATION CLBP BENEFITS (Short-Term & Long-Term Disability Insurance)

CLBP Benefits are for presently employed I.A.M.A.W Local Lodge 11 members.

This coverage is for Non-Work related injury or disability.

Starting March 1, 2024 the CLBP Benefit Coverage Plan is :

1 week elimination / 26 weeks STD / 26 weeks EI / 11 weeks STD / LTD after

What is CLBP Insurance?

- CLBP Insurance coverage is to provide Short-Term and Long-Term disability insurance benefits to I.A.M Local Lodge 11 members.

How do I pay for CLBP monthly premiums?

- All I.A.M L.L. 11 members are enrolled into CLBP and pay monthly CLBP insurance deduction on their payroll. Bi-weekly contribution deductions are 3.4% of you annual salary (example if your hourly rate is $36.08 then your annual salary is $ 71763.12 which your 3.4% bi-weekly contribution deductions are $93.84.

When can I apply for CLBP Benefits if I meet the requirement for Insurance coverage?

- Member can start CLBP application process (application & doctor form) as soon as possible. Reminder that there is a 1 week elimination period. Your benefits coverage will start from week 2 and onwards.

CLBP Member Canada Life Coverage Booklet :

Fact Finder Online Resource :

Why does the coverage stop at age 65?

- The Insurance company coverage is only for members aged 65 or less and so member will not pay into the CLBP insurance premiums after age of 65.

Where can I get CLBP coverage Insurance forms and more information regarding CLBP Benefits?

- Please speak to CLBP Trustee’s which will assist with forms and insurance information.

Who are the CLBP Trustee’s?

- Bryan Buckland, David Lau, Sumit Hallen

Please don’t hesitate to ask any questions or concerns regarding the plan or claims to your CLBP Trustee’s. All Information Regarding Claims and Benefits will be kept confidential.

I.A.M.A.W Local Lodge 11

Group Disability Benefit Plan

Frequently Asked Questions:

- What is the waiting (elimination) period before I would be eligible for benefits?

An “elimination period” is a period of time during which you must be absent from work due to a total disability before you are eligible for disability benefits. Short-Term (STD) benefits are payable following an uninterrupted period of one week. Long-Term (LTD) benefits are payable following a period of 64 weeks of total and continuous disability.

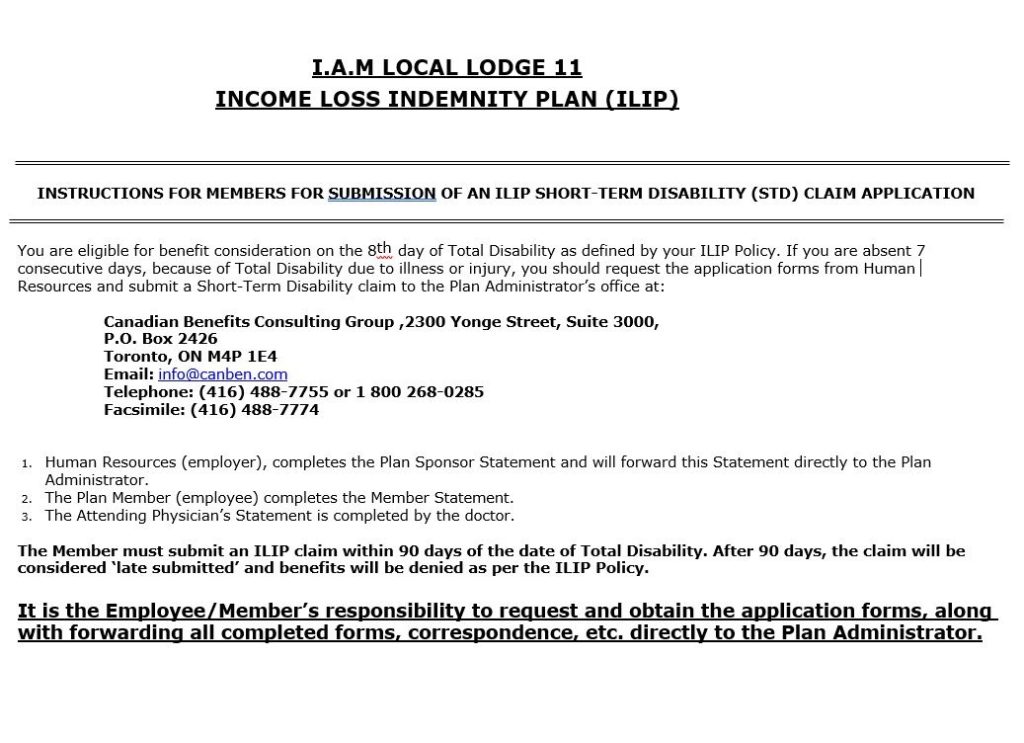

2. How do I apply for Short-Term Disability Benefits (STD)?

Complete claim documentation are required by your Plan Administrator, and comprises three claim statements:

- Employer (Policyholder) Statement

- This form will be completed by Avcorp Industries and returned to the Plan Administrator

- Employee (Member) Statement

- This form should be completed in its entirety by you and returned to the Plan Administrator

- Attending Physician Statement

- This form should be completed in its entirety by your attending physician/specialist and returned to the Plan Administrator

Ideally, all forms (Member Statement; and Attending Physician Statement) should be returned as a package to the Plan Administrator. It is important to start the claim process as soon as possible following the one-week elimination period. Once your claim forms are submitted to the Plan Administrator, you would normally be contacted by the Plan Administrator within the first 7 days of submitting your claim forms– if for any reason you have not been contacted, please contact the Plan Administrator at the coordinates listed below.

NOTE: Canadian Benefits Consulting Group must receive notice of your STD claim within 90 days from the date of your disability. Failure to submit your entire claim package within the notice period will result in the declination of your claim. Canadian Benefits Consulting Group does not Case Manage the LTD claim.

3. How are my STD benefits calculated?

Your STD Plan provides you with a tax-free benefit equal to 55% of your weekly insurable earnings.

4. How are my LTD benefits calculated?

Your LTD Plan provides you with a tax-free benefit equal to 50% of your gross monthly earnings.

5. How will my STD/ LTD claim be evaluated?

Your Disability Case Manager is the single point of contact specifically assigned to the management of your claim. Your Disability Case Manager examines the information provided and determines if you are eligible for LTD benefits. The first step is to ensure that your coverage is still in effect. The next step involves reviewing the medical information regarding your diagnosis, treatment and limitations, then analyzing this information based on the tasks related to your job to determine your ability to carry out your work

Your Disability Case Manager will contact you to conduct a ‘telephone interview’ with specifically designed questions to assist in understanding your condition and your medical limitations.

6. How will I be informed of the decision of my STD/ LTD claim?

Whether your claim is accepted, pended or denied, your Disability Case Manager will call you to inform you of the decision. The Disability Case Manager will also send you written confirmation and, in the case of denial, a detailed explanation of the reasons for the decision

7. What can I expect while on Disability and in receipt of STD/ LTD benefits?

If your claim has been accepted and benefits paid, (medical updates) will be requested from time-to-time from your treatment provider. The Case Manager may also request to forward a copy of all Specialist Assessments, Consultation Reports, all test results, etc. You will be asked to complete Functional telephone interviews and updates on a regular basis. The detailed information you provide during these calls will assist with Case Manager understanding how your condition impacts your activities of daily living compared to your pre-disability function.

During the course of your claim, an ‘Independent Medical Examination (IME)’ may be arranged. If this occurs you will be notified by your Disability Case Manager. This is used for a second opinion of your condition when medically warranted and is not dictated by you or your doctor, but is the sole discretion of the insurance company

8. If my claim is accepted, when do my payments start?

STD benefit payments will be processed bi- weekly.

LTD benefit payments will be paid from the date the “elimination period” is completed (64 weeks). Benefits will be payable for each period of total disability after 64 weeks of continuous total disability with no interruption in disability greater than 90 days for the same condition and no greater than 30 days for an unrelated condition; or, if later, on the date that any payment of benefits under the weekly income and sickness insurance or the Employment Insurance Act of Canada, ends. LTD benefits are paid on a monthly basis in arrears.

9. How long will I receive LTD benefit payments?

Your LTD benefit payments will continue as long as you meet the definition of total disability and satisfy other obligations (such as pursuing appropriate treatment). Generally speaking, the insurance company will consider whether you are “totally disabled” from your own occupation for a period of 12 months following the elimination period. After this period of time, your claim will then be considered whether you are “totally disabled” from any occupation. In the event that you remain continuously and totally disabled, benefits may continue until you reach age 65, retire, or die, which occurs first

10. What if I receive income from another source? How will that impact my benefit?

You must inform the insurance company of all sources of income from the start of your disability.

Your LTD benefits are reduced by payments received from other sources, such as CPP Disability Pension, Motor Vehicle Accident benefits, Workers’ Compensation, and alternate employment. If you receive a retroactive award, you will be expected to reimburse the insurance company any benefits overpaid.

11. Why might I be asked to apply for Canada Pension Plan Disability Benefits (CPP)?

It is mandatory under the ILIP Policy to apply for CPP Disability benefits if your Disability Case Manager requests an application be completed.

If you are eligible for CPP Disability benefits and you don’t apply and no longer contribute to CPP, this would have an adverse effect on your CPP Retirement benefits as the retirement pension is an earnings-related benefit; the pension amount depends on your level of earnings during your contributory period. When you retire and eligible for CPP Retirement benefits, CPP Disability will automatically convert your pension to CPP Retirement at age 65 (without having to reapply) and the CPP Retirement benefit will carve-out the period of CPP Disability benefit period to determine the contributory period for calculation of retirement benefits. In addition, CPP applies an inflation increase every year and the percentage of increase is not included in the LTD benefit offset reduction. As well, if you have eligible dependent children, you could receive an additional monthly benefit for your dependent children which are also not included in the LTD benefit offset reduction.

12. If my claim is denied or if my benefits are terminated, what are my options?

If you claim is denied or your benefits are terminated, your Disability Case Manager will call you and send you an explanatory letter that include the time lines to pursue an appeal. Your Disability Case Manager will describe how to proceed and identify the documents to provide if you wish to challenge the decision and appeal.

Any Appeals must be put through the insurance company and must be supported by medical documentation. If you have new medical information and believe your claim should be paid, you should contact your Disability Case Manager.

Your Plan Administrator will assist you with any questions, concerns regarding your claim.

This communication has been prepared to help you better understand your Group Insurance Plan. However, it does not take the place of any contractual or other rights. In the event of a discrepancy between any information contained in this communication, the terms of the Group Policy will apply.

YOUR ILIP BOARD OF TRUSTEES

IAMAW Local Lodge 11 Health & Welfare Board of Trustees

Bryan Buckland Sumit Hallen David Lau

Chairperson Trustee Trustee